- African Market Insights

- Posts

- New Post

New Post

- Energy Infrastructure Gap Creates $15B Annual Investment Window: Africa's massive electricity deficit presents unprecedented opportunities for infrastructure investors and DFIs

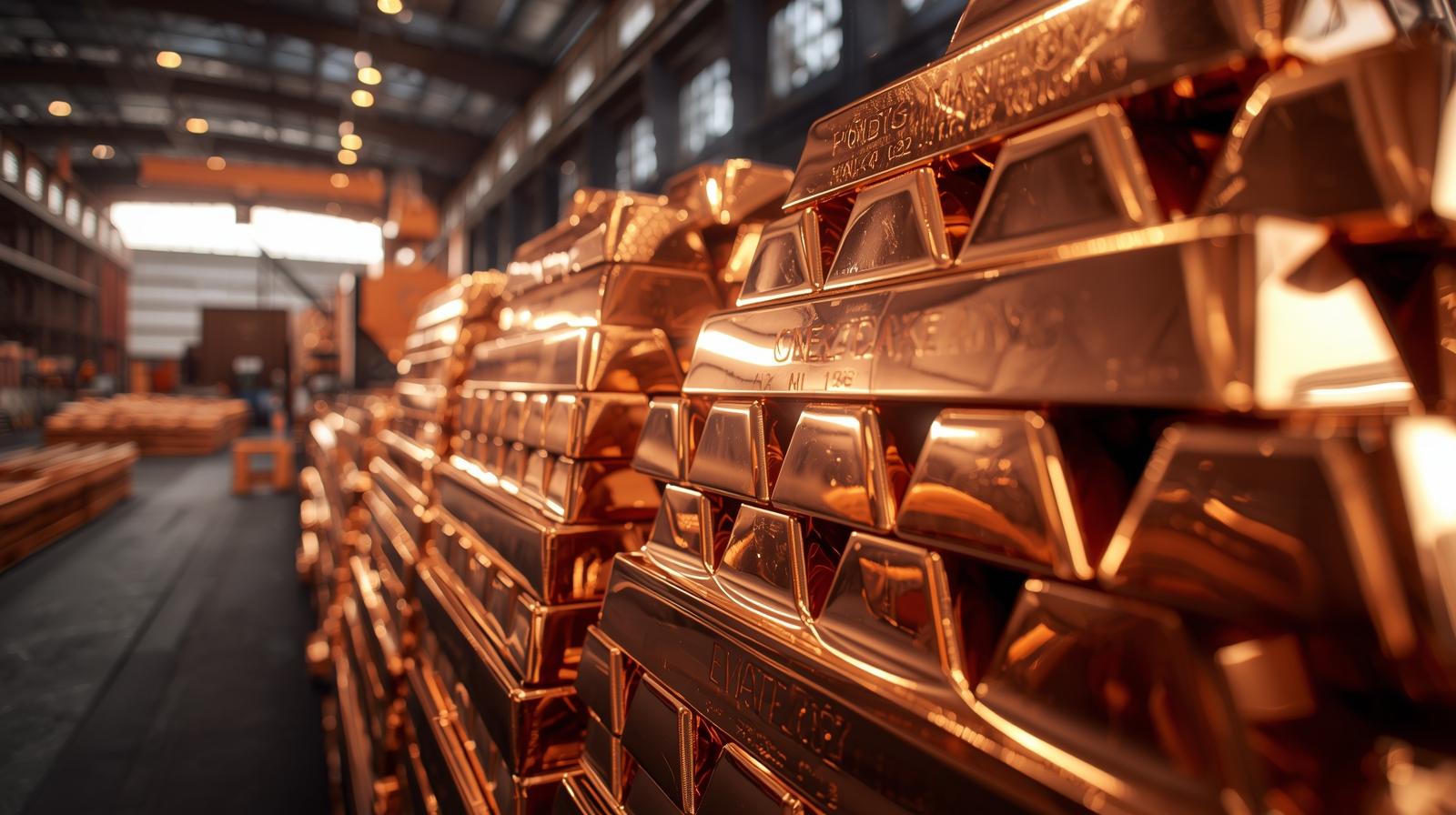

- Resource Sector Renaissance Drives Capital Deployment: Zambia's $10B copper expansion and debt-to-investment programs signal renewed confidence in African mining and sovereign partnerships

- Digital & Financial Market Liberalization Accelerates: From Ethiopia's capital market opening to Zambia's telecom surge, regulatory reforms are unlocking new investment frontiers

|

Africa's $15 Billion Energy Gap Defines Next Investment Cycle

- Infrastructure Investors: Grid expansion and transmission projects offer immediate entry points with reduced bottlenecks for renewable deployment scaling

- DFIs and Multilaterals: Blended-finance structures targeting the $15 billion gap through upcoming forums in Paris (April 22-23) and Cape Town

- Energy Strategists: Dual-track deployment combining hydrocarbon development with renewable reinvestment offers optimal net-zero pathway

- Regional Operators: Frontier basin opportunities intensify as major producers face reserve declines of hundreds of thousands of barrels daily

Zambia Copper Investment: $10B Growth to 3M Tons by 2031

Zambia's mining renaissance demonstrates how systematic policy reform can accelerate capital deployment, with $10 billion attracted over four years through a three-tier strategy targeting triple production growth to 3 million tons by 2031. The ambitious timeline faces execution risk, with 2026 representing a critical milestone—sustained output above 1 million tons will validate the recovery trajectory and justify aggressive post-2026 expansion.

Infrastructure constraints present both challenge and opportunity: achieving 3 million ton production requires approximately 10 GW additional electrical capacity and enhanced smelting infrastructure. Tripling production demands direct mining employment to jump from 56,000 to 200,000 jobs, plus 300,000 indirect positions, creating substantial supply chain expansion opportunities for training providers, equipment suppliers, and logistics operators.

Italian PM Meloni announces debt-to-investment plan for 'vulnerable' African countries

Italy's debt-to-investment conversion program transforms African sovereign debt into development investments while introducing climate-shock debt suspension clauses, positioning Italy as a strategic economic partner through the broader Mattei Plan. This initiative creates structured pathways for DFIs and sovereign investors to participate in debt restructuring deals tied to long-term infrastructure and development projects.

The program addresses regions facing instability, including Sudan and eastern Democratic Republic of Congo, potentially compressing political risk premiums as fiscal stability improves in these high-yield markets. Climate-conditional debt relief frees up fiscal space for African governments to co-invest in public-private partnerships for water, energy, and transportation infrastructure aligned with AU Agenda 2063.

IMF concludes 2026 Article IV discussions in Morocco, noting strong growth, rising investment needs

Morocco's economy projects 4.8-4.9% growth in 2026, supported by strong investment and solid agricultural output, though managing rising investment needs and SOE fiscal risks remains critical to sustaining trajectory.

Read MoreIHS Towers and Government Drive $100M Investment in Zambian Telecoms

IHS Towers drives $100M telecom investment amid Zambia's ICT sector surging to 17.4% of GDP, while pending $6.2B MTN Group acquisition could reshape African tower operations and 5G readiness strategies.

Read MoreFirst International Institution Applies for Investment License in Ethiopia

Ethiopia's first international capital market license application signals growing foreign confidence in financial liberalization efforts, with thousands of companies eyeing joint-stock conversions creating substantial advisory and brokerage demand.

Read More

|

📧 Forward this newsletter to colleagues interested in African business intelligence

🔗 Visit Africa Insights AI for detailed market analysis

© 2026 Africa Insights AI. All rights reserved.